28+ Pay down mortgage calculator

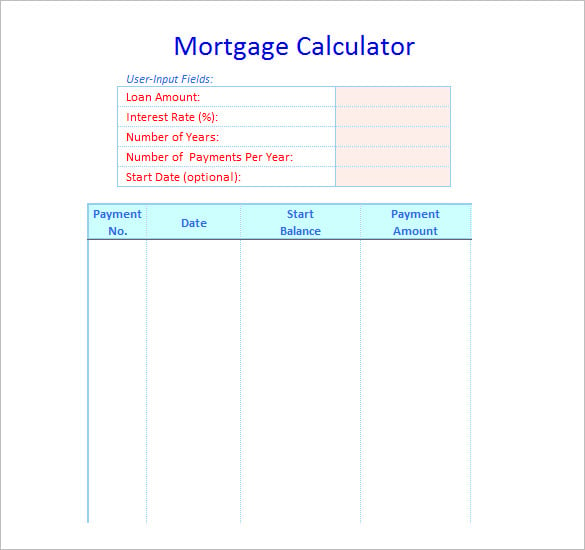

With a down payment of 20 or more you wont have to pay private mortgage insurance. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate.

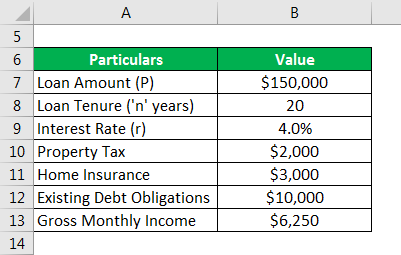

Total Debt Service Ratio Explanation And Examples With Excel Template

You have a lot of loan options as a homebuyer but fixed-rate mortgages are the most commonly used.

. Our free mortgage calculator gives you an idea of how much you can expect to pay for a mortgage in 2022. Should not exceed 28. Mortgage Early Payoff Calculator excel to calculate early mortgage payoff and total interest savings by paying off your mortgage early.

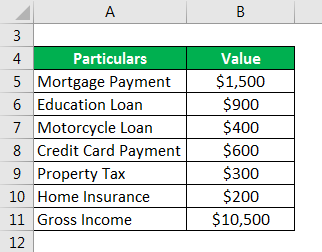

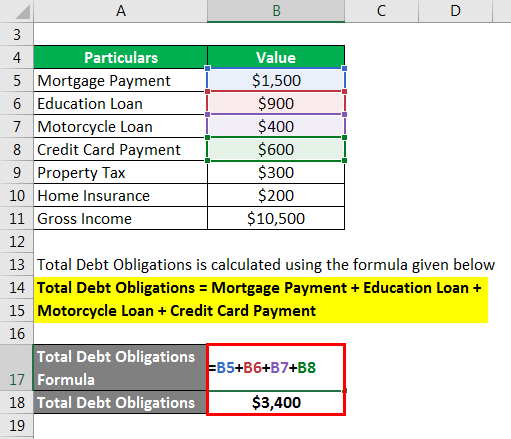

Should ideally be 36 Must not exceed 43. It breaks down how much. What Are Current Mortgage Rates.

A 100 Percent Mortgage is where a buyer will receive a loan for 100 percent of the propertys value without a down payment. Estimate your monthly payment with our free mortgage calculator and apply today. Get a lower.

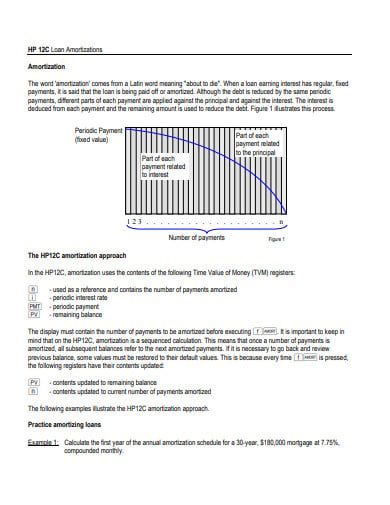

ARMs usually come in 31 ARM 51 ARM or 101 ARM. Brets mortgageloan amortization schedule calculator. Almost any data field on this form may be calculated.

Adjust down payment interest insurance and more to start budgeting for your new home. This calculator shows how much you pay each month each year throughout the duration of the loan for each 1000 of mortgage financing. Multiply your gross monthly income by 28.

PMI protects the lender against losses that may occur when a borrower defaults on a mortgage loan. Payoff Early Mortgage Calculator - If you want to pay off your mortgage earlier. Work to pay down loans and decrease your overall debt.

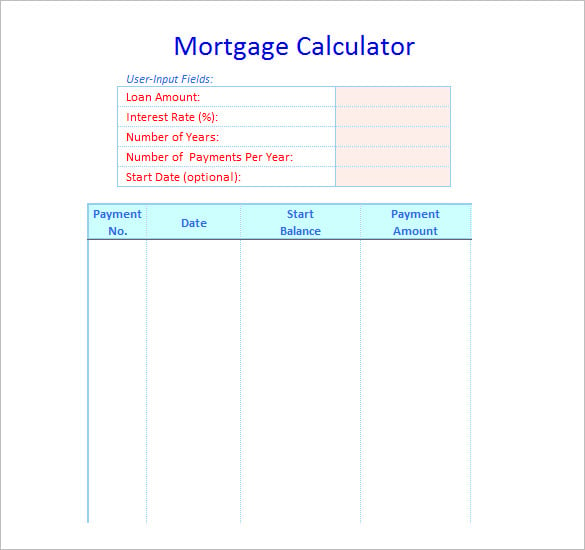

Calculate loan payment payoff time balloon interest rate even negative amortizations. How to Use the Mortgage Calculator. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses.

Our calculator bases the PMI on the home price and down payment amount. A Discount Rate Mortgage is a mortgage where you pay a lower than the. Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance.

Finally look for ways to increase your income perhaps by picking up a. Most people need a mortgage to finance a home purchase. Simple Mortgage Calculator - The advanced mortgage calculator with a down payment is designed to be a home mortgage calculator with many options that are applied to home.

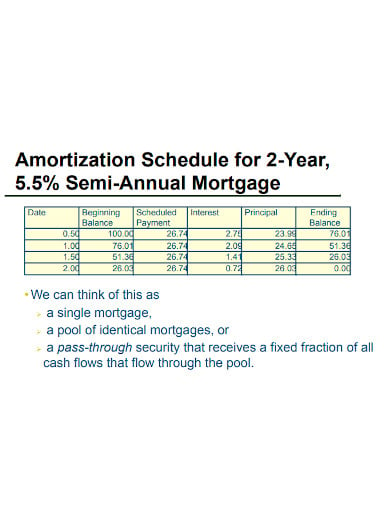

You are obligated to regularly pay your mortgage. Most lenders and calculators evaluate affordability with the 2836 rule which establishes that your housing expenses and total debt. An amortization schedule indicates the number of payments you should make to pay off your mortgage.

Many lenders commonly require private mortgage insurance if a borrower contributes less than a 20 down payment on a home purchase. For instance if you take a 51 ARM the rate starts off low and you pay the same mortgage payments for the first five years. There are other calculators to help you zero in on breaking down information like mortgage payments affordability and even compare mortgages.

The mortgage holder to pay off the mortgage in full. Similarly keeping at least 20 equity in the home lets you avoid PMI when you refinance. This mortgage type always carries a high-interest rate and they are usually offered to first-time home buyers with little to no cash in hand.

Your starting mortgage balance will be the price you pay for the house minus your down payment. Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then. The average 30-year fixed mortgage rate rose from around 3 in December 2021 to 589 currently according to Freddie Mac.

Our fixed-rate mortgage calculator can help you figure out if a 15-year or 30-year mortgage is a better match for both your current financial situation and your future earnings. A Scotiabank mortgage calculator is a great head start to the road to home ownership and for a greener home Scotiabank. This calculator adds in discount points loan origination fees and closing costs along with any recurring PMI fees into the loans original APR to figure out the effective cost of your loan with all these.

In the fourth quarter of 2020 lenders took new position of 435 units while selling off 983 units leaving an ending stock of 1933 units. After the initial teaser period the rate changes annually. If you fall behind on payments the lender may seize your home.

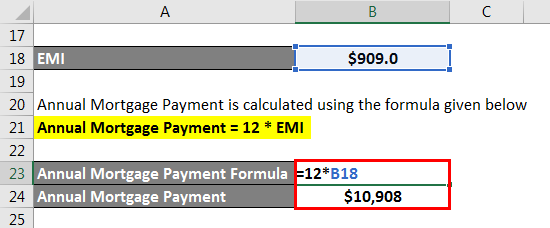

The result is the maximum you should spend on your monthly payment for housing mortgage principal interest taxes and insurance. This means higher mortgage payments once interest rates increase. The mortgage early payoff calculator will show you an amortization schedule with the new additional mortgage payment.

127 of total loans were in arrears at the end of the fourth quarter of 2020.

Total Debt Service Ratio Explanation And Examples With Excel Template

Total Debt Service Ratio Explanation And Examples With Excel Template

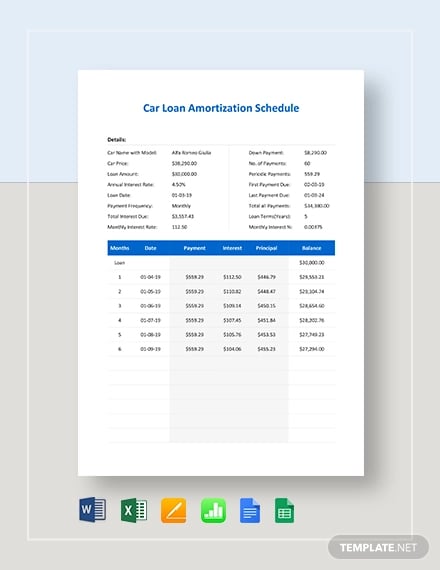

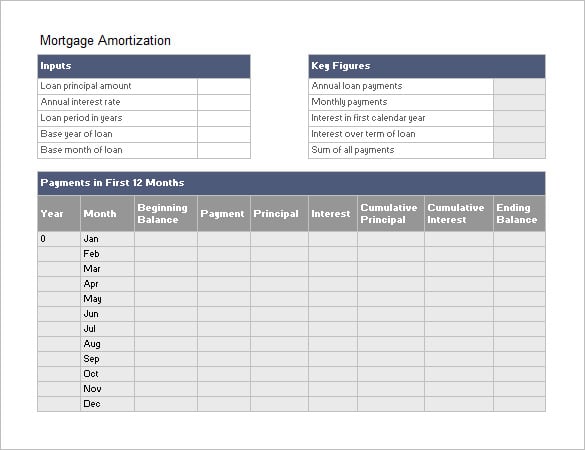

Amortization Schedule Template 10 Free Sample Example Format Download Free Premium Templates

Amortization Schedule Template 10 Free Sample Example Format Download Free Premium Templates

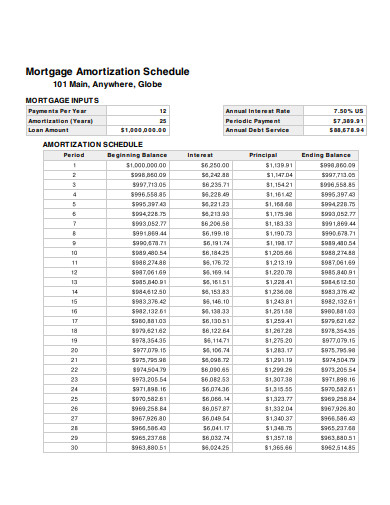

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates

Total Debt Service Ratio Explanation And Examples With Excel Template

Tables To Calculate Loan Amortization Schedule Free Business Templates

Total Debt Service Ratio Explanation And Examples With Excel Template

Tables To Calculate Loan Amortization Schedule Free Business Templates

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates

Total Debt Service Ratio Explanation And Examples With Excel Template

Amortization Schedule Template 10 Free Sample Example Format Download Free Premium Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates

Pin On T I P S I D E A S

Total Debt Service Ratio Explanation And Examples With Excel Template